KUALA LUMPUR, Aug 4 (NNN-BERNAMA) — The High Court today was told that no due diligence was taken by 1Malaysia Development Berhad (1MDB) before entering into a joint venture (JV) worth US$6 million with a company purportedly linked to an Abu Dhabi sovereign wealth fund, International Petroleum Investment Company (IPIC).

Former 1MDB chief executive officer, Datuk Shahrol Azral Ibrahim Halmi said no formal due diligence was taken with regard to Aabar BVI Ltd, which the 1MDB board of directors took as a subsidiary of IPIC.

Aabar Investment PJS was the real subsidiary of IPIC, while Aabar BVI Ltd was a company incorporated by fugitive businessman, Low Taek Jho or Jho Low and his associates in British Virgin Islands that was wound up and dissolved in June 2015.

The ninth prosecution witness said he, however, did not take the liberty to verify the fact if the two ‘Aabars’ were the same and only took the representation of the company from Jho Low.

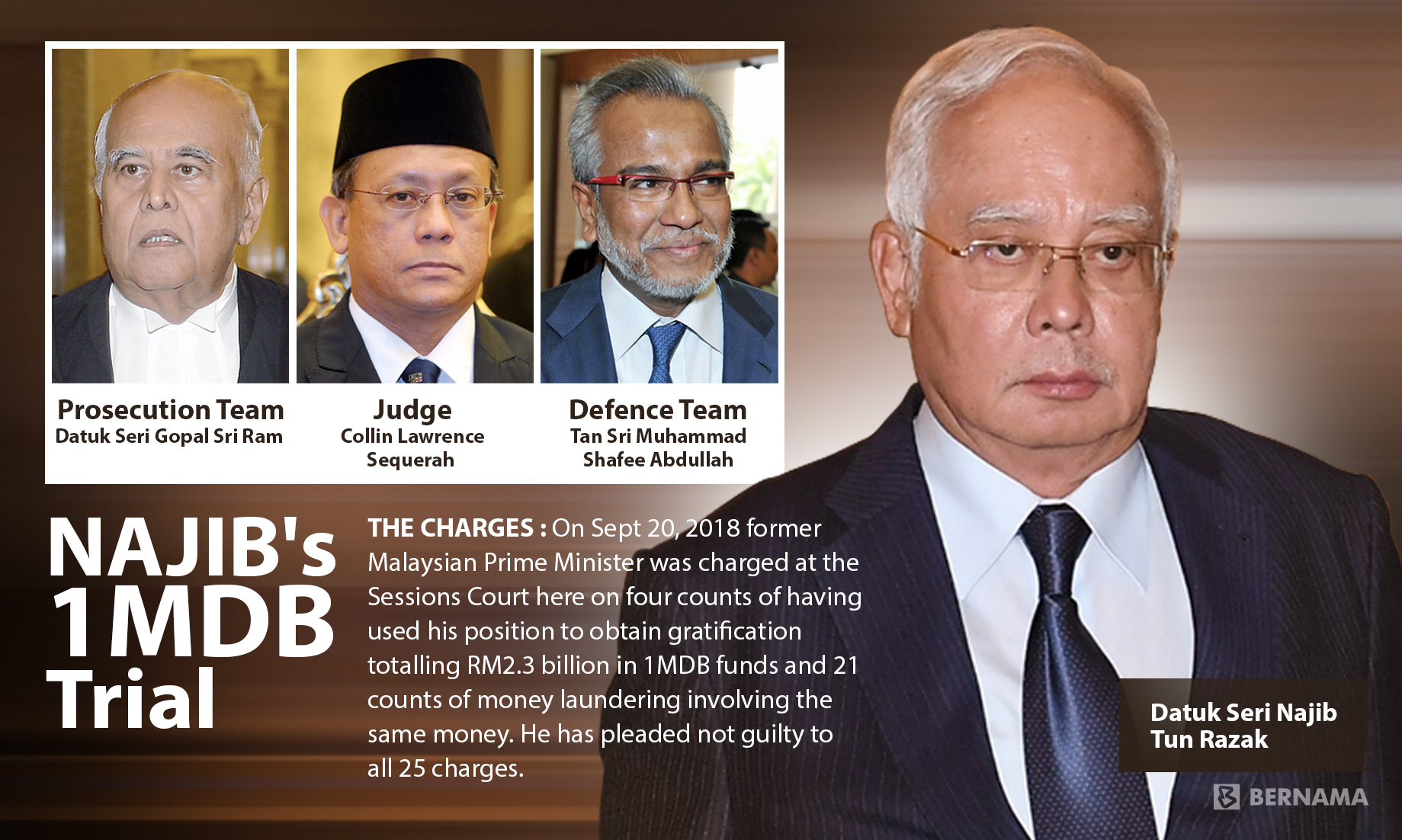

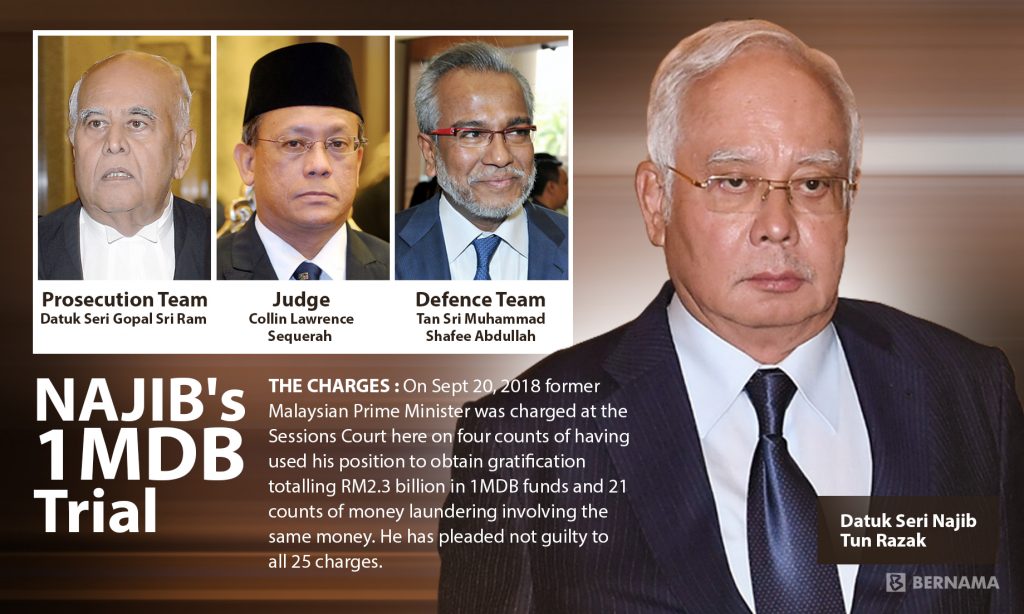

Shahrol Azral was being cross-examined by lead defence counsel, Tan Sri Muhammad Shafee Abdullah at former prime minister, Datuk Seri Najib Tun Razak’s RM2.3 billion 1MDB graft trial.

Muhammad Shafee: …but you were going into a JV of US$6 million with this company?

Shahrol Azral: During that time, we (1MDB board of directors) had no reason to doubt it. On hindsight, I agree it would be prudent to do so.

Muhammad Shafee: You agree with me, the Goldman Sachs (1MDB financial advisor) team led by Tim Leissner, was supposed to be taking due diligence on both Aabars?

Shahrol Azral: If anything was amiss, we would expect Goldman Sachs to tell us as the paid financial advisor.

Last year, United States officials had barred Leissner from the securities industry after he pleaded guilty to bribery and money laundering conspiracy charges related to 1MDB and is scheduled to face sentencing in a federal court in Brooklyn, New York soon.

Meanwhile, the witness also agreed to a suggestion by the lawyer that since 1MDB had failed to check (on the due diligence) because of their good faith in Jho Low’s representation of the company, they would expect Goldman Sachs to do so.

Further questioned by Muhammad Shafee, Shahrol Azral said he was not shocked when IPIC denied having any connection with Aabar BVI Ltd in 2016.

“It was in 2015 when I heard all the revelations about 1MDB from the media. Don’t get me wrong, but emotionally I was kind of numb already after hearing reports swirling about how they (1MDB) spent the money…so I was not surprised and just left it to the investigators,” said the witness.

Muhammad Shafee then went on to the little details such as the differences in the letterhead and signatures in the documents presented by Aabar BVI Ltd to 1MDB, to which Shahrol Azral replied that he nor the 1MDB management had realised it during that time.

Muhammad Shafee: So nobody in the 1MDB management brought up this issue (the differences) to you?

Shahrol Azral: No.

Muhammad Shafee: When the entire management in 1MDB did not see the differences, you could not expect the prime minister and finance minister at that time (Najib) to notice it.

Shahrol Azral: No comment.

For the record, it was stated in the Public Accounts Committee (PAC) report that 1MDB had paid over RM4.24 billion to Aabar BVI Ltd in 2012 for a security deposit.

Throughout the proceeding today, Muhammad Shafee who referred Aabar Investments PJS as ‘big Aabar’ and Aabar BVI Ltd as ‘small Aabar’, said the 1MDB management had once again fallen into ‘cobra pits’ in its investment dealing.

Muhammad Shafee: Do you notice that we are moving in many cobra pits…1MDB must be run by a bunch of idiots to walk through these pits.

Shahrol Azral: I’d like to reserve my comment on that.

After the lunch break, another counsel, Wan Aizuddin Wan Mohammed referred the witness to a shareholders’ minutes signed by Najib as a representative of Minister of Finance (Incorporated) (MoF Inc), which included the appendix of the terms and conditions of a land deal on the development of Kuala Lumpur International Financial District (now known as TRX) between Aabar BVI Ltd and 1MDB.

Shahrol Azral said he did not know if Najib had seen the minutes together with the appendix and he did not take the step of briefing him before executing the document.

Wan Aizuddin: Do you know whether this (shareholders’ minutes together with the appendix) was shown to Najib or not?

Shahrol Azral: I have no direct knowledge.

Wan Aizuddin: Looking at the content, do you agree on the face of the document, the impression is that the joint venture was between 1MDB and the real Aabar?

Shahrol Azral: Yes.

Wan Aizuddin: Is it safe to say that for the uninitiated, when you see 1MDB and Aabar Investments PJS Limited (Aabar BVI Ltd), a person not warned of the peculiarity may take this for the (real thing)?

Shahrol Azral: Yes.

Najib, 67, faces four charges of using his position to obtain bribes totalling RM2.3 billion from 1MDB funds and 21 charges of money laundering involving the same amount.

The trial before judge Collin Lawrence Sequerah continues tomorrow.