By Massita Ahmad

SINGAPORE, March 5 (NNN-BERNAMA) — An ease in the Malaysian economy as well as the ongoing COVID-19 outbreak seemed to have taken a toll on its tycoons, says Forbes Asia, which released its 2020 Forbes Malaysia Rich List Thursday.

Forbes Asia said the wealth of the country’s 50 richest fell for a second straight year due to a weaker ringgit and a decline of close t 10 percent in the country’s benchmark stock index.

Their collective net worth of US$79 billion is down 7.0 per cent from a year ago, it said.

Nonagenarian business legend Tan Sri Robert Kuok took up the top spot again with a net worth of US$11.5 billion, a position he has held for over two decades.

Kuok was among four of the listed whose wealth shrank by more than US$1 billion in the past year.

Retaining his spot at number two, Quek Leng Chan of Hong Leong group, added US$300 million to his fortune of $9.7 billion.

Ananda Krishnan of Maxis took the third spot with a net worth of US$5.9 billion, down by US$300 million from the year before.

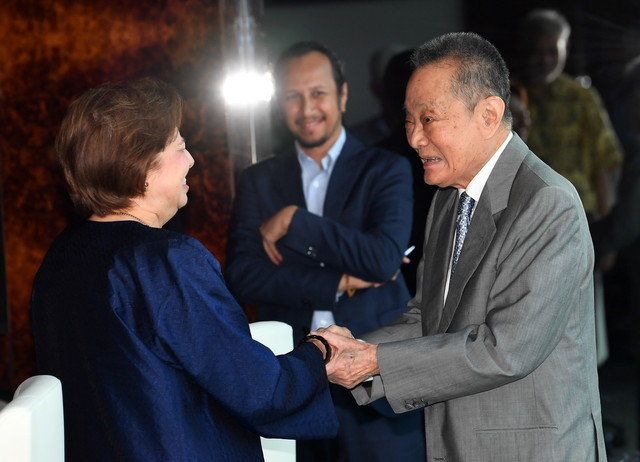

The hardest-hit in dollar terms was banking tycoon Dr Teh Hong Piow (No. 5, US$4.85 billion).

The founder of Public Bank saw his fortune buffeted by headwinds in Malaysia’s banking industry, slipping two spots from No. 3 last year.

Teh saw US$1.85 billion shaved off his wealth since the last list as shares in Public Bank, the country’s second-largest bank by market value, declined roughly 30 per cent.

In addition to Kuok and Teh, Lim Kok Thay (No. 7, US$3.2 billion) and Hap Seng’s Lau Cho Kun (No. 10, US$2.3 billion) also saw their wealth reduced by more than US$1 billion as their fortunes fell by US$1.2 billion and US$1.1 billion respectively.

AirAsia’s Dr Tony Fernandes (No. 41) and Kamarudin Meranun (No. 43) saw more than a third of their fortunes shaved to US$335 million and US$315 million respectively.

In all, 22 of Malaysia’s richest suffered a slide in their net worth from a year ago, but an equal number were modestly better off.

Among the latter group was casino mogul Dr Chen Lip Keong, who moved into the top five for the first time at No. 4.

Booming growth at Chen’s NagaWorld casino complex in Cambodia, prior to the coronavirus outbreak, helped push his net worth up 6.0 per cent to US$5.3 billion.

Another notable gainer was Kuan Kam Hon (No. 9), who controls Hartalega Holdings, the world’s largest maker of nitrile gloves.

His net worth grew US$400 million to US$2.8 billion, from $2.4 billion a year ago.

There were five newcomers on the list, the richest of whom are a pair of inheritors.

Debuting at No. 6 were brothers Lee Yeow Chor and Lee Yeow Seng, who share a combined US$4.8 billion legacy left by their father Dr Lee Shin Cheng, the architect of the IOI palm oil and property empire, who passed away last June.

Other new listees include two tech entrepreneurs: Chu Jenn Weng (No. 47, US$280 million), founder of electronics maker ViTrox; and former Hewlett-Packard engineer Oh Kuang Eng (No. 50, US$255 million), whose Mi Technovation makes semiconductor equipment.

NNN-BERNAMA