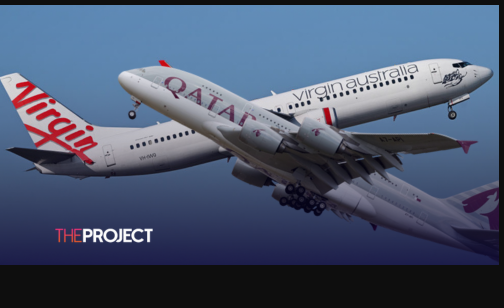

CANBERRA, Feb 27 (NNN-AAP) – The Australian government has approved Qatar Airways’ acquisition of a 25 percent stake in the nation’s second-biggest airline.

Treasurer Jim Chalmers, said today that, the government’s Foreign Investment Review Board has approved Qatar Airways’s move, to purchase a 25 percent stake in Virgin Australia from its owner, Bain Capital.

In a statement, Chalmers said that the deal would strengthen competition in Australia’s aviation.

“It will increase Virgin Australia’s capacity on key international routes and provide a long-term pathway for the airline to operate its own long-haul flights,” he said.

“The proposal is also expected to deliver broader economic benefits, including more job creation in Australia, support for the tourism industry and enhancing Australia’s position as a key travel hub.”

Under the deal, Virgin plans to return to long-haul flights with services between Sydney, Brisbane and Perth and Doha, from June, and between Melbourne and Doha from Dec, subject to approval from the International Air Services Commission. Those flights will be operated using aircraft wet-leased from Qatar Airways.

Jayne Hrdlicka, outgoing chief executive of Virgin Australia, said that, the deal represented a “new era” for the airline and Qatar Airways Chief Executive, Badr Mohammed Al Meer, described it as a “huge boost to our shared ambition to create even greater choice and value for all Australian passengers.”

The deal was announced in Oct, and is still subject to formal approval from the Australian Competition and Consumer Commission, which said in a draft decision, released earlier in Feb that, it was planning to grant authorisation.

Virgin is Australia’s second-largest airline and the sole competitor to Qantas, and its budget carrier Jetstar, on major domestic routes.

In Apr, 2020, it became one of the first airlines globally to collapse during the COVID-19 pandemic.

Bain Capital, a U.S. private investment firm, bought the troubled airline for 3.5 billion Australian dollars (2.2 billion U.S. dollars) and brought it out of voluntary administration in Nov, 2020.– NNN-AAP