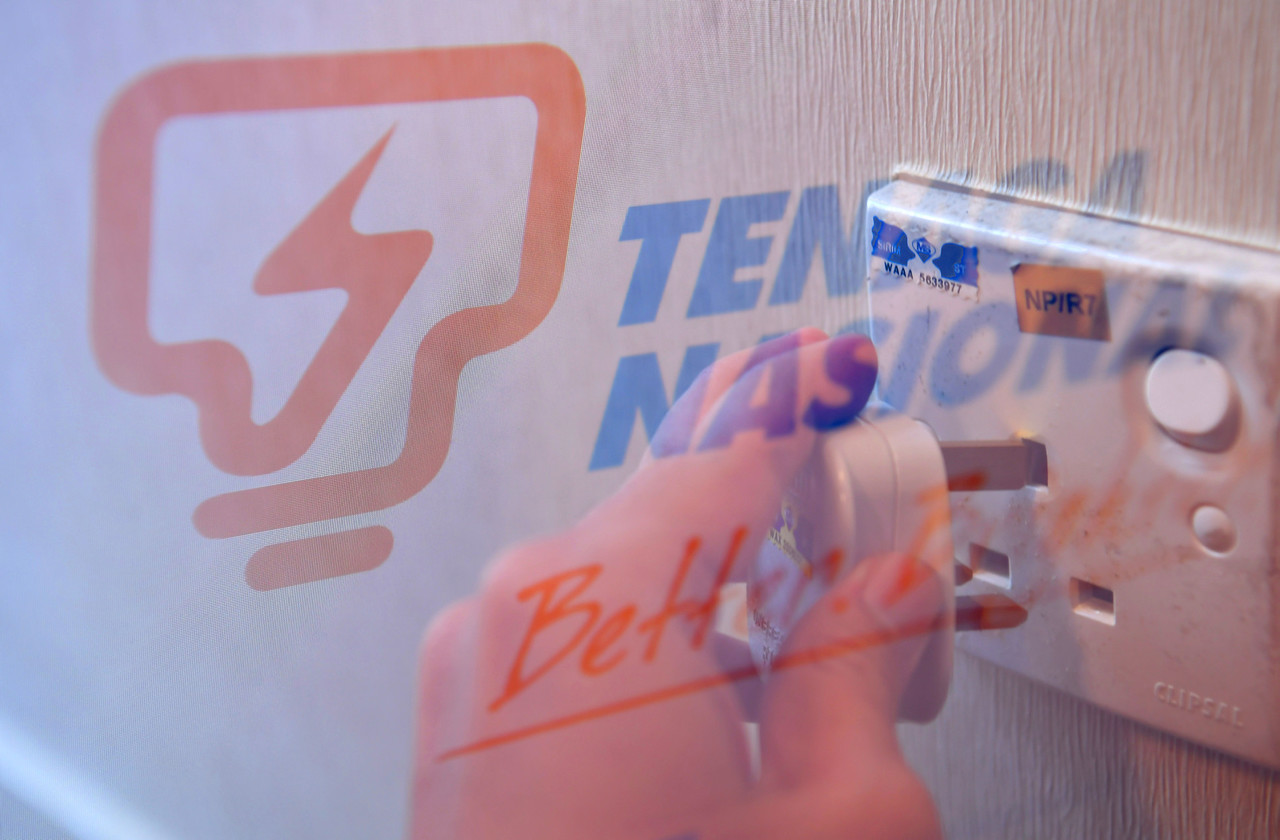

KUALA LUMPUR, Aug 24 (NNN-Bernama) — Malaysia’s largest electricity utility, Tenaga Nasional Bhd (TNB), via its wholly-owned subsidiary TNB Topaz Energy Sdn Bhd (TNBTE), has divested all of its 105.6 million units of Tranche 1 investment in the compulsorily convertible debentures (CCD) issued by GMR Bajoli Holi Hydropower Private Ltd (GBHH) of India for 1.176 billion Indian rupees (US$15.9 million).

TNB said the divestment of its CCD investment was driven by its strategy to streamline its international portfolio, defocusing on India, and shifting its efforts to pursue growth in TNB’s focus markets such as the United Kingdom, Europe and Southeast Asia.

“The divestment is also consistent with TNB’s initiatives to seek monetisation options for its assets in India and other non-focus markets,” the utility giant said in a filing with Bursa Malaysia Tuesday.

On Dec 10, 2018, TNBTE inked an agreement to subscribe to CCD issued by GBHH, a subsidiary of GMR Energy Ltd, for 2.256 billion rupees (about US$30.4 million). The CCD, with a tenure of 30 years, was to be converted into an equity stake of about 30 per cent before the end of tenure.

On April 5, 2019, TNBTE subscribed into Tranche 1 of the CCD investment for 1.056 billion rupees (US$14.2 million).

TNB said the project was expected to start commercial operations by October 2019, but its commissioning was delayed due to unforeseen circumstances.

Following the delay in project completion, TNBTE did not proceed with Tranche 2 of the CCD investment subscription of 1.2 billion rupees, originally scheduled by September 2019.

Subsequently, TNBTE and GMR Infrastructure Ltd, the parent company of GMR Energy, entered into the divestment.

TNB said the divestment would not have any effect on its share capital and substantial shareholders’ shareholdings, and was further not expected to have a material effect on the company’s net assets and gearing.

— NNN-BERNAMA