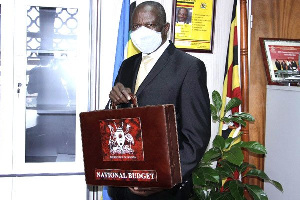

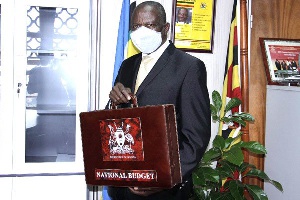

Finance minister Matia Kasaijja

KAMPALA, Dec 4 (NNN-AGENCIES) — The Ugandan Government has indefinitely suspended payment of all allowances for its workers due to poor cash flow.

However, the Ministry of Finance said the payments for the staff of State House, Ministry of Defence and other priority agencies and statutory obligations would not be affected.

The suspended payments include subsistence, lunch, mileage, transport and overtime allowances.

These allowances constitute nearly 80 per cent of civil servants’ upkeep as their payroll salaries are largely inadequate.

In a memo issued by the Accountant General, the deferment would also affect government payments for compensations arising from court awards and other litigation processes through the Attorney General.

However, Minister of Finance, Matia Kasaija, downplayed the cash crisis and dismissed the speculation that government has run broke.

“We are just short on cash. Being broke and being short on cash are two different things,” he said by telephone.

“Things will get back to normal, we are trying to get a loan from somewhere I cannot tell you, as we also work on our revenues stream,” he added.

In the 2020/2021financial year budget, government scrapped facilitation for foreign and domestic travel as a way of cost-cutting.

Spokesperson of the Finance Ministry, Jim Mugunga said: “The Ministry of Finance and government at large, remain committed to serving and honouring obligations in accordance with the budget … there is no need for panic and government is not broke.”

At the commencement of the current financial year in July, government borrowed $300m (about Shs1 trillion) from World Bank in addition to $491m (Shs1.8 trillion), which had been acquired from the International Monetary Fund to plug budgetary deficits following the Coronavirus pandemic and the lockdown that nearly brought the economy to its knees.

The country’s economic growth projections for this year have since been revised down, with real GDP expected to recover later in 2021 to about 3.7 per cent—which is still a 2.5 per cent decline compared to the pre-Covid projection. — NNN-AGENCIES